As you know, in the past year or so, another refinancing frenzy broke out due to low mortgage rates. Everyone is “fat and happy.” Even though the current rates are still low, the housing market remains turbulent, unemployment rates, and the possibility of inflation continue to be troublesome. Many lenders have tightened borrower requirements in order to mitigate their risk, given today’s economy.

Mark Gorman

Recent Posts

When Refinances Dry Up

Aug 1, 2021 3:16:00 PM / by Mark Gorman posted in Marketing, Sales Pipeline, Mortgage Lenders

How to Serve Underserved Markets

Jul 22, 2021 12:30:00 PM / by Mark Gorman posted in Marketing, Legal, Community Reinvestment Act

The Community Reinvestment Act (CRA) is a federal law that was first passed in 1977. Its purpose was to assure that banks did not discriminate against individuals or businesses within their communities, including underserved markets such as low and moderate-income (LMI) neighborhoods. The Federal Reserve System (FRS), the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC) all evaluate how banks are fulfilling the CRA.

Since banks can get fined for not serving these areas of their community, we’ve put together a guide on what you need to know about the Community Reinvestment Act and how you can increase your minority and LMI lending.

Does Zillow Produce the Best Leads for Mortgage Lenders?

Jul 12, 2021 10:33:00 PM / by Mark Gorman posted in Marketing, Sales Pipeline

Overview:

For today’s homebuyers, there are countless ways to browse potential homes: Zillow, realtor.com, Trulia… You could have a whole folder on your smartphone just for these home buying apps.

That means for mortgage lenders, there are countless sources to buy potential leads from. For real estate agents, about half of them that purchase online leads don’t actually see a return on their investment. And which sources of leads are profitable for mortgage lenders?

In this blog, we’ll reveal the truth about buying leads from Zillow and introduce you to a more profitable option.

How Lenders Are Leveraging Technology

Jun 7, 2021 3:13:00 PM / by Mark Gorman posted in Marketing, Sales Pipeline, Mortgage Lenders

Overview

Advances in technology have no doubt changed the ways businesses operate, and the real estate industry is no exception. 98% of all homebuyers now use the internet to shop for their homes and last year, 80% of all Millenials and Gen Xers found their home with a mobile device. Today, homebuyers can take a virtual stroll through a neighborhood across the country, or search for new listings simply by downloading an app on their phone.

But what do these changes mean for mortgage lenders?

In this blog, we’ll go over everything you need to know about leveraging technology to secure more lending opportunities.

The Modern Homebuying Experience for Mortgage Lenders

May 20, 2021 10:56:00 PM / by Mark Gorman posted in Marketing, Sales Pipeline, Mortgage Lenders, Process Improvement

Overview:

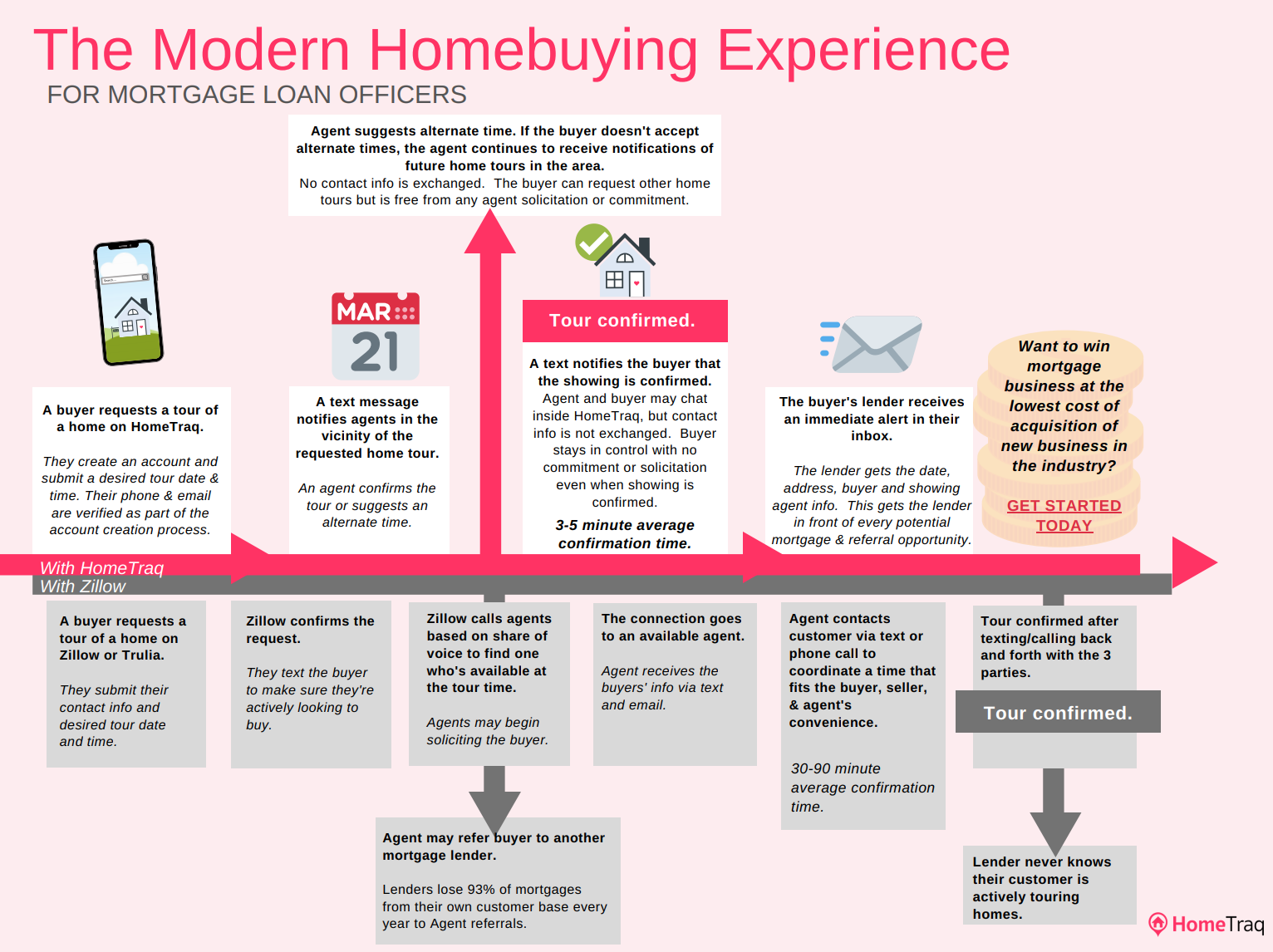

This infographic shows how the HomeTraq experience compares to zillow when it comes to putting mortgage lenders in front of the right opportunities. Don't complicate the process. Implement a plan to get your team in front of the action before the competition.

Tips for Realigning Your Sales Effectiveness

Mar 15, 2021 11:02:47 AM / by Mark Gorman posted in Marketing, Sales Pipeline, Mortgage Lenders

Overview

Many people think the best way to grow their business is to hire more Mortgage Loan Officers to develop relationships with real estate agents to start bringing more customers through the door. Others wait too long and suffer from disorganization and missed opportunities.

That’s why we’ve put together this comprehensive guide, so you don’t miss out on any lending opportunities. A quick hint? Not all of it comes down to adding more people. You can leverage your current workforce more efficiently. Take these factors into consideration, so you can make a more informed decision about how to effectively win more mortgage businesses.

Reclaiming A Credit Union's Member Base

Mar 8, 2021 1:03:34 PM / by Mark Gorman posted in Marketing, Sales Pipeline, Case Study

The Customer:

Our customer is Alliance Credit Union, a not-for-profit financial cooperative. Originally chartered in 1948 to serve the financial interests of Emerson Electric Co. employees, today’s Alliance serves communities throughout Greater St. Louis.